Creating wealth oriented solutions

that work harder for you

At MSCI, the client always comes first. We have over 40 years’ experience of developing and refining our support tools for the investment community. We can enable you to make tough decisions more confidently. We also understand the challenges of legacy systems, by-passing this potential obstacle with an integrated solution that can fit neatly into your existing systems.

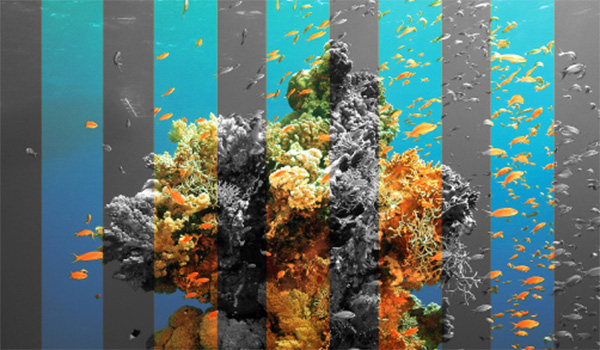

Solving the ESG puzzle

Investors are increasingly looking to wealth managers to help them understand the environmental and social impacts of their investments.

MSCI offers an ecosystem of support for ESG investing. From portfolio modeling to reporting, wealth managers around the world are leveraging data, indexes, analytical and reporting tools, and insights from MSCI to help clients turn ESG preferences into more sustainable portfolios with better risk-adjusted returns.

Explore more wealth management solutions from MSCI

More from MSCI

Aligning with the Paris Agreement: An Index Approach

Climate-related risks, whether physical or related to a transition to a lower carbon economy, are changing the risk-return profile of individual companies and entire industries, leading to new and increased risks in investors’ portfolios.

Is US Equity Overvalued? A Macro View

The U.S. equity market rebounded strongly following the historic crash in March 2020, defying a still uncertain outlook on the COVID-19 pandemic and economy. Investors may ask: Is this a sustainable recovery, or a bubble that may burst?

Using Factors As a Magnifying Glass for Equities

Amazon.com Inc., Microsoft Corp., Netflix Inc. and Zoom Video Communications Inc. were all perceived winners as the world shifted to remote working and learning amid the COVID-19 pandemic. Did these stocks, so often grouped together by the media, have the same investment characteristics driving their stock prices?