Rumi Mahmood, Research Director, MSCI Sustainability Institute

Transition funds are not homogenous in their construction given variable interpretation of what transition is, says Rumi Mahmood, Research Director at the MSCI Sustainability Institute.

What are transition funds?

While many ‘green’ investments focus on renewables and clean industries, transition investments target sectors that are currently emissions-intensive or lack clean alternatives but are actively working toward lower-carbon solutions. These industries are either in the process of transitioning or providing the technologies, services, or innovations that enable broader society to transition to a low-carbon economy. Transition funds often have a broader mandate than pure-play green investments.

Some funds focus on mitigating transition-related financial risks, investing in companies that are either managing those risks or positioned to benefit from transition-driven opportunities. Others align with EU Paris-aligned benchmarks, particularly the climate transition benchmarks, which require a target decarbonization rate based on the emissions performance and trajectory of the underlying companies.

Our analysis found that nearly 80% of transition funds are aligned with an implied temperature rise of less than 2.5°C, and around one-third are on track for a 1.5°C target. Furthermore, one-fifth of these funds have more than half their market value invested in companies with long-term net-zero targets for 2051 or earlier, with near-term goals approved by the Science Based Targets initiative for completion by 2030.

Why are they increasing in popularity?

Transition funds have emerged as the fastest-growing category of climate funds in recent years, with nearly 70% of them launched in the past four years. Globally, there are now 139 transition funds managing over $50 billion in assets. For many investors, particularly in Europe, these funds are seen as long-term investments rather than tactical, short-term plays. Pension funds and fiduciaries are increasingly looking to capitalize on the broader, long-term trend toward decarbonization and the global shift to a low-carbon economy.

Despite the lack of a globally standardized definition of transition investments or transition finance, investors continue to flock to these funds. The variation in interpretation of what qualifies as “transitional” means the funds in this category are not homogenous in their construction, allowing for a wide variety of strategies and approaches. This flexibility appeals to investors looking for diversified ways to manage climate-related risks and opportunities over the long term.

What’s under the hood of the funds themselves?

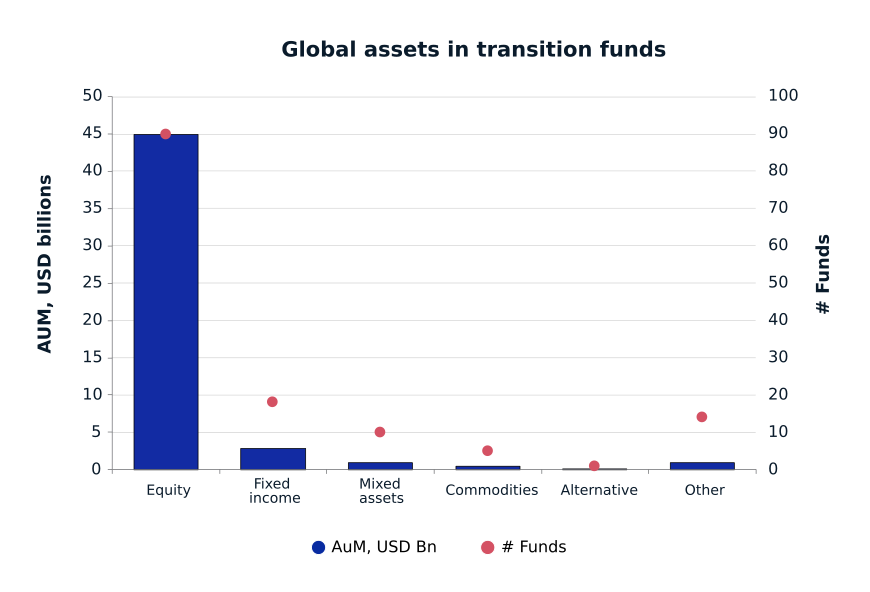

The majority are equity strategies, accounting for more than $45bn, with a handful of fixed income funds and even fewer in mixed assets, commodities, alternatives and other.

Since most of these funds are actively managed, with each adopting its own interpretation of “transition,” identifying consistent stock selection patterns can be challenging. Some funds broaden their focus beyond energy transition to include social and environmental transitions, further contributing to diverse strategies and definitions.

Portfolio sizes and compositions vary widely, from small, high-conviction strategies with fewer than 50 holdings to large, globally diversified portfolios with over 1,000 companies. However, some trends do emerge. At the sub-industry level, the most common allocations are in specialty chemicals, semiconductors, electrical components, and diversified metals and mining. Among the most frequent holdings are Schneider Electric, which specializes in digital automation and energy management; Albemarle Corporation, a specialty chemicals manufacturer; and Atlas Copco, a leader in industrial machinery and components.

Interestingly, some of the lowest allocations are found in the energy and real estate sectors—industries that are traditionally considered harder to decarbonize, which may be counterintuitive given the emphasis on transitioning to a low-carbon economy.

Geographically, where are assets invested?

While most transition funds are domiciled in Europe and primarily cater to European investors, over 70% of the assets are invested in U.S.-based companies. This is partly due to market capitalization, as many funds are benchmarked to market-cap indices, and U.S. equities hold the largest allocation in global markets. Additionally, the U.S. has gained momentum from the Inflation Reduction Act, which has been a tailwind the growth of solution providers, technology innovators, and carbon capture and storage systems.

Surprisingly, less than 6% of transition fund assets are invested in emerging markets, which might seem counterintuitive given that these regions arguably face the most urgent need for decarbonization. This could be attributed to a combination of risk factors and the size of companies in these markets. Many emerging market companies developing climate solutions may not meet the size criteria necessary to attract institutional investment, reflecting a broader challenge in balancing opportunity with risk appetite for these regions.

How are transition funds performing? What does the future look like for them?

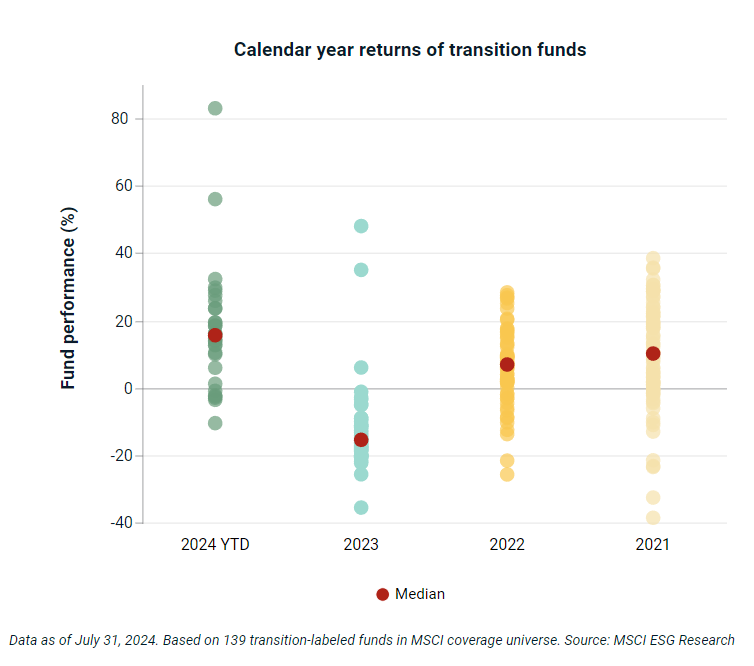

In the first seven months of 2024, most transition funds posted positive returns. In 2023, 48% outperformed their benchmark or parent index, with the top-performing fund delivering nearly a 30% return, surpassing the MSCI All Country World Climate Change Index. However, performance was mixed in prior years, with many funds posting negative returns in 2022 and 2021.

While the long-term outlook for these funds remains yet to be seem, as demand for climate-related investments grows, given their exposure to specific sub-industries and sectors, the performance of more focused transition funds is expected to be cyclical, influenced by broader market conditions, macroeconomic trends, and geopolitical factors.

Data from MSCI ESG Research, As of September 12, Olive Is the New Black: The Rise of Transition Funds

More from MSCI

Solutions for Wealth Managers

We power portfolio design, customization and analytics, creating client value at scale for wealth managers.

ESG Ratings & Climate Search Tool

Search by company name, ticker or fund to view the ESG and climate risks and opportunities the company or fund might face

Understanding Institutional Investors’ Perspective on ESG Ratings

This report aims to provide issuers with a sense of how investors may think about ESG factors across the entire investment process.