Portfolio personalization:

An ESG case study

In this case study, we consider the preferences of a wealth manager’s client who is a socially responsible investor and seeks to avoid companies with business activities related to controversial weapons, tobacco, alcohol, gambling, fossil-fuel extraction and the like. The client also prefers to invest in companies that have been relatively proficient at managing ESG risks and capitalizing on ESG opportunities.

We use the MSCI USA ESG Leaders Index as a proxy for the CDI, as it excludes companies in line with the investor’s preferences and includes “best-in-class” companies with high MSCI ESG Ratings from each sector.

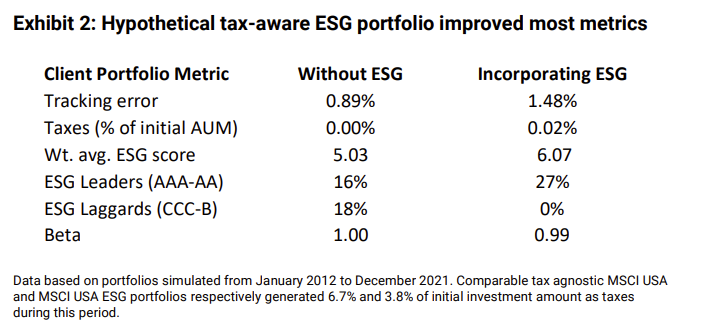

The wealth manager may optimize to reduce or defer taxes through the selection of companies from the CDI, while minimizing tracking error relative to the MSCI USA Index. In Exhibit 2, we show the results for a hypothetical 100-stock direct-indexing portfolio that was built with (and without) a CDI that incorporates ESG considerations. In this case, the MSCI USA ESG Leaders Index is used as a proxy for the CDI. Incorporating ESG preferences increased the overall ESG score of the portfolio and improved representation from companies with the highest ESG ratings. While this approach came at the cost of higher tracking error, it did not result in a significant tax burden.

For some investors, the benefit of aligning investments with personal preferences may well exceed the trade-off of higher portfolio tracking error versus a market-cap-weighted reference. They may even choose a closer alignment of investment preferences over a reduction in taxes. However, having an illustration of the magnitude of that trade-off can help investors make an informed decision.

Portfolio implementation: Fractional- vs. whole-share ownership

As direct indexing is more broadly adopted outside of the high net-worth segment, some wealth managers are positioning fractional-share capabilities (where managing positions contain less than one full share of equity) as a dependency to efficiently execute a direct indexing strategy, particularly if the initial portfolio assets under management (AUM) is less than USD 1 million.

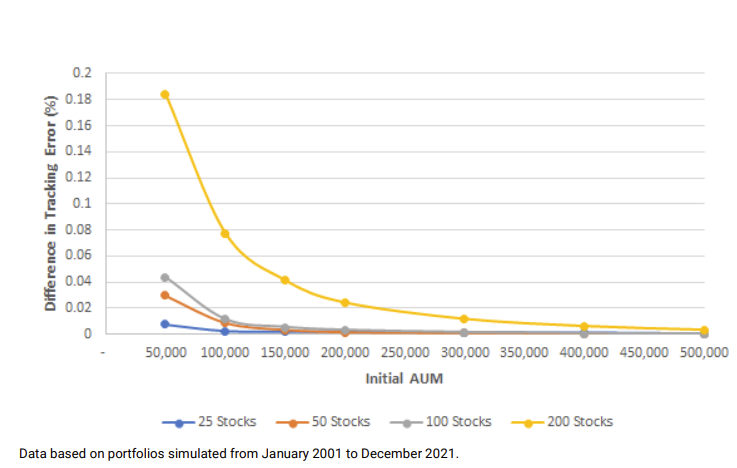

In this section, we look at whether tracking error would have remained low even with whole shares in account sizes between USD 50,000 and USD 500,000. To do so, we compare hypothetical fractional- and whole-share setups for client portfolios tracking the MSCI USA Index. In this example, the investor has not expressed any additional preference to the wealth manager, so we are using the MSCI USA Index as a proxy for the CDI. We derived the whole-share portfolio from the fractional-share portfolio by simply rounding the number of shares to the nearest whole number.

We found the whole-share portfolio had higher tracking error, as the fractional-share portfolio was optimized for lower tracking error. Any deviation from that portfolio would have resulted in higher active risk (on an ex-ante basis). We note that the whole-share portfolio’s tracking error was only marginally higher (shown in Exhibit 3), because a significant proportion was allocated identically between the two portfolios and differences arose only from the rounding of fractional-share positions.

Exhibit 3: Portfolio tracking error: Fractional share vs. whole share

Additionally, we found portfolio differences were marginally sensitive to portfolio size (as measured by AUM) as well as the number of stocks. For smaller portfolios and larger numbers of securities, the dispersion in tracking error widened but was still marginal. For instance, an investor with USD 50,000 could have historically tracked the MSCI USA Index in whole shares (<=200 stocks), while limiting the tracking-error increase to under 20 basis points. This implies that an investor could track the index reasonably well even without access to fractional-share service.

Explore more on Direct Indexing from MSCI

‘What is Direct Indexing’ Infographic

MSCI EAFE Expanded ADR Index

More from MSCI

Matching Portfolios and Clients’ Expected Returns, with Factors

Wealth managers face the challenge of matching clients’ objectives with an ever-growing set of investment products. Standard practice is to build strategic asset-allocation models based on broad capital-market assumptions. But we present a new approach.

ESG and Climate Adviser Guide

The ESG and Climate Guide for Financial Advisers by MSCI ESG Research explains key sustainable investing concepts from the difference between ESG and impact investing to how to use reporting to learn about your client’s unique values.

.

40% Women on Boards — the New Frontier

The number of women on boards continues to rise. While a 30% board gender diversity target has long been the magic number, the continued evolution of boards, both by choice and by regulation, means 40% women on boards is becoming the new frontier.